ఝండేవాలన్, ఢిల్లీలో అమ్మకాలు / వ్యాపార అభివృద్ధి jobs కోసం హైర్ చేసుకుంటున్న టాప్ కంపెనీలు ఏవి?

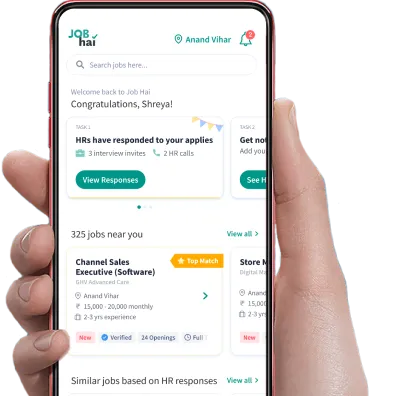

Ans: FINBUD FINANCIAL SERVICES PRIVATE LIMITED jobs, Hdfc Ergo jobs, PRIME SEARCH jobs, GIST MANAGEMENT SOLUTIONS PRIVATE LIMITED jobs and ALPINE ENERGIES PRIVATE LIMITED jobs లాంటి టాప్ కంపెనీలతో పాటు ఝండేవాలన్, ఢిల్లీలో అమ్మకాలు / వ్యాపార అభివృద్ధి jobs కోసం హైర్ చేసుకుంటున్న ఇతర కంపెనీలు కూడా Job Haiలో ఉన్నాయి.