साकेत, दिल्ली में नवीनतम अकाउंटेंट जॉब्स कैसे प्राप्त करें?

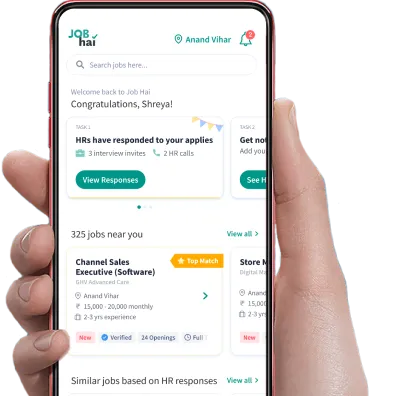

Ans: आप अपने पसंदीदा शहर के रूप में दिल्ली, स्थानीयता के रूप में साकेत और category के रूप में अकाउंटेंट Job Hai ऐप या वेबसाइट पर चयन कर सकते हैं। आपको अकाउंटेंट जाब की रोल के लिए चुनने के लिए सैकड़ों अलग-अलग जॉब्स मिलेंगी। और अकाउंटेंट, साकेत में अकाउंटेंट जॉब्स के लिए apply करें।

साकेत, दिल्ली में अकाउंटेंट जॉब्स के लिए शीर्ष कंपनियां कौन सी हैं?

Ans: Job Hai में कई शीर्ष कंपनियां हैं जैसे INFOEDGE jobs, ARA CONSULTANTS jobs, RED DASH MEDIA LLP jobs, VS CONSULTANCY SERVICES jobs and THE B.TECH RESTAURANT jobs, और कई अन्य कंपनियां साकेत, दिल्ली में अकाउंटेंट जॉब्स के लिए काम पर रखती हैं।